David Immerman is as a Consulting Analyst for the TMT Consulting team based in Boston, MA. Prior to S&P Market Intelligence, David ran competitive intelligence for a supply chain risk management software startup and provided thought leadership and market research for an industrial software provider. Previously, David was an industry analyst in 451 Research’s Internet of Things channel primarily covering the smart transportation and automotive technology markets.

1. Digital transformation – when aligned with business value – scales to new heights.

Innovative technologies such as IIoT and artificial intelligence (AI) drive great excitement with organizations fantasizing of never-ending possibilities and transformative change. Enthusiasm has unfortunately led some companies awry and into digital transformation proof-of-concept (PoC) purgatory – a place where costs add up quickly and significant results are not achieved. We’ve had customers say they had identified nearly 100 IIoT use cases on their immediate roadmap, where realistically they should be prioritizing only four or five.

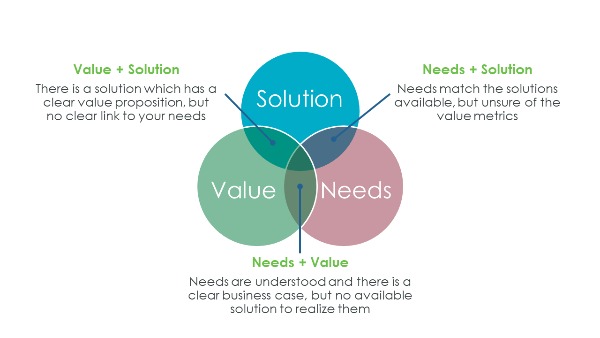

While we are equally excited at the possibilities of DX, IIoT, and other technological innovations entering industrial marketplaces, it is increasingly critical to first develop a digital transformation strategy that aligns with an organization’s strategic business needs or goals, desired outcome or value, and the technology or solution that will enable this great change.

Having this mindset and a plan is crucial to avoiding PoC purgatory and escaping out of it if needed. We’ve constructed the needs, value, and solution framework (see below), which includes considerations beyond the technology being adopted.

Over the next few years, we predict industrial organizations with value-oriented DX mindsets will have a clear advantage in terms of accelerating time-to-value and scaling DX initiatives across the enterprise. Aligning with a similarly inclined digitally native partner only improves the rate of success; in PTC’s State of The Industrial Internet of Things report, 89% of respondents expect to transition use cases to production within a year of purchase.

2. Macroeconomic uncertainties press industrial companies toward internal operational efficiencies.

Even with stock markets reaching all-time highs and unemployment rates record lows, macroeconomic issues such as the worker shortage and trade wars are spreading seeds of doubt in some industrial companies. The PMI is at its lowest since 2009 and teetering slightly above 50, meaning just over half of manufacturers are optimistic of the future of the industry.

If the economy does downturn into a recession, industrial organizations will need to cut costs and technology, including IIoT, will play a critical role. Manufacturers will look at technology solutions that optimize the workforce, improve productivity, and drive operational efficiencies. The World Economic Forum reports new efficiencies are still the primary driver for large companies to invest in new technologies.

3. Rise of augmented reality in operations-oriented use cases.

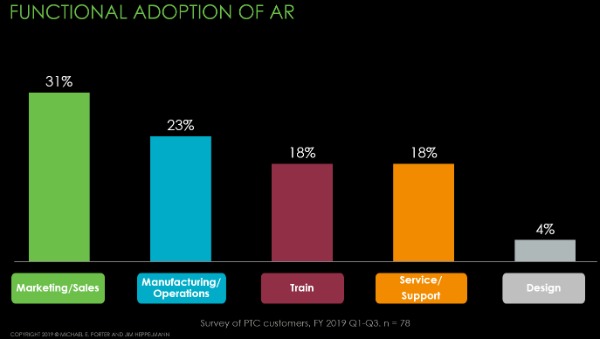

In 2019, sales and marketing use cases for augmented reality were identified as the most prevalent in a PTC customer survey. Augmented brand experiences and interactive consumer products provide a great entryway for companies and their customers to familiarize and immerse themselves with AR and its potential. It is also driving revenue opportunities today with manufacturers like Polaris and Fuijitsu. These forward-thinking companies are equipping their dealerships and customers with AR to illustrate different product customizations and features in real time.

With a growing familiarity of the technology and advancements in AR hardware, we anticipate a shift in adoption to use cases operating in mission-critical industrial environments. Here are a few examples of emerging AR use cases:

- Volvo Group is equipping its quality assurance operators with virtual work instructions on inspection lines for flexibility, agility and quality.

- Howden is empowering its customers with AR service instructions to ensure asset uptime.

- GlobalFoundries is scaling its experts and standardize operating procedures through AR to reduce production bottlenecks.

AR will become a critical workforce technology within industrial processes connecting humans to the physical environments they work in and drive critical operating KPIs for their organizations.

4. Cloud adoption will reach a tipping point in the industrial market.

Adopting the cloud and its different compute service delivery forms (IaaS, PaaS, SaaS) will become tablestakes across industries and heavy-industrial firms including manufacturers. The public cloud doesn’t just offer an avenue to more effectively manage a company’s current IT resources but also provides the on-ramps to rolling out innovative technologies and next-generation applications.

Industrial companies are turning on IIoT devices to their networks at record paces. IIoT platforms are providing the fundamental framework necessary to manage these increasingly heterogeneous environments. The cloud is taking these deployments a step forward with the scalable infrastructure to more efficiently manage IIoT connections, at a facility-to-facility and global level.

Many are rethinking their current usage of on-premise legacy software and moving to more flexible cloud-based SaaS platforms. Using SaaS as a delivery format for traditional enterprise software including ERP and CAD alleviates total cost of ownership, provides differentiating value through more rapid software updates to innovative features, and increases accessibility to critical data and applications.

Forming cloud strategies will be critical for industrial enterprises now and in the near future. IDC predicts by 2023, 70% of manufacturers will use cloud-based innovation platforms and marketplaces and Gartner forecasts the SaaS cloud applications services market will reach $113 billion in 2021.

5. Digital partnerships will be key to effective IIoT implementation.

Two ill-advisable strategic decisions are inhibiting many from recognizing successful IIoT projects: spot solutions and ‘do-it-yourself’. Much of operational technology decision-making is made on a factory-by-factory individual basis by general managers, assembly supervisors or stationary engineers without a company-wide strategy in mind.

These ‘spot solutions’ are technologies that solve a single use case or issue, typically with only short-term requirements in purview. This temporary fix inhibits future scaling as it often isn’t interoperable with other systems across the value chain.

DIY refers to any company opting to build instead of buy IIoT capabilities. Research shows three out of four DIY IoT projects are failures, as companies cannot overcome significant hurdles including costs, time, resources, and scaling.

Effective IIoT implementations are taking the form of industrial companies partnering with digital allies to form technology ecosystems inclusive of cloud and security infrastructure, solution development technology, and experienced systems integrators.

Deloitte recognizes manufacturers turning to technology partnerships for ‘digital momentum’, developing new business models and value to customers at 5x and 2x the rate of others, respectively. We’re seeing this trend, too: Through adopting an IIoT platform, NSW is building IIoT solutions 10x faster than they were historically able to do for customers.

6. Industrial companies move toward sustainability and embrace technologies that enable it.

As the planet’s global carbon emissions and correlating social pressures mount for health, wealth distribution and safety, organizations will see sustainability as a strategic initiative versus the traditional cost center. Government subsidies and regulations have been the call to change, especially in the automotive and aerospace industries, but it’s also a competitive advantage.

The EPA cites 66% of manufacturers believe sustainability is essential to remain competitive in the marketplace. Plus, increasingly organizations with eco-efficient operations, facilities, and programs will be a lucrative customer selling point and recruitment tool.

External incentives aside, adopting sustainability practices will be a growing method to drive operating efficiencies. A couple examples:

- Applying IIoT to assets across a factory, multiple sites or remote locations enables intelligent optimization that can drastically cut energy costs.

- Using generative design and additive manufacturing to create longer-lasting and more efficient products can reduce scrap while also improving quality.

Plan for change in 2020 – and beyond

The next decade will come with great change and disruption to markets and organization’s processes in-place. But these forces also provide an avenue for great opportunity where industrial incumbents can preemptively capitalize on these technology trends, implement strategic initiatives, and put best practices in-place to do so. Successful companies will embrace this change as a strategic differentiator in the competitive landscape as they shift from a ‘place to a pace’.