PTC Announces Fourth Quarter Fiscal Year 2018 Results

First Quarter Bookings and Revenue Exceed High End of Guidance Range

NEEDHAM, MA, October 24, 2018 PTC (NASDAQ: PTC) today reported financial results for its fiscal fourth quarter and fiscal year ended September 30, 2018.

- Fourth quarter GAAP revenue was $313 million; non-GAAP revenue was $322 million

- FY'18 GAAP revenue was $1,242 million; non-GAAP revenue was $1,252 million

- Fourth quarter GAAP net income was $13 million or $0.11 per diluted share; non-GAAP net income was $53 million or $0.45 per diluted share

- FY’18 GAAP net income was $52 million or $0.44 per diluted share; non-GAAP net income was $171 million and $1.45 per diluted share

- Fourth quarter license and subscription bookings were $149 million and subscription mix was 81%

- FY’18 license and subscription bookings were $466 million and subscription mix was 76%.

- Total deferred revenue, billed and unbilled, was $1,410 million, an increase of 29% from the same period last year

- Fourth quarter subscription Annualized Recurring Revenue (ARR) was $544 million, an increase of $205 million or 61% from the same period last year

“We are very pleased with our fourth quarter results and strong finish to the fiscal year,” said James Heppelmann, President and CEO. “Despite currency headwinds in the quarter, recurring software revenue grew 15% year over year, reflecting the strength of our subscription model, and new bookings were strong.”

Heppelmann continued, “Fiscal 2018 was another year of great progress in our transformation to become a high-growth subscription software company and industrial IoT leader. During the year, we delivered good results in our core CAD and PLM businesses, ThingWorx continued to gain significant traction with both new and expanding customers, and interest in our augmented reality (AR) solutions accelerated. We also made important strides in extending our market reach and further differentiating our technology with new strategic partnerships entered into during the year.”

Additional operating and financial highlights are set forth below. Information about our bookings and other reporting measures (as updated) is provided beginning on page five. For additional details, please refer to the prepared remarks and financial data tables that have been posted to the Investor Relations section of our website at investor.ptc.com.

- Q4’18 license and subscription bookings were $149 million, up 4% year over year. FY’18 license and subscription bookings were $466 million, up 11% year over year.

- Q4’18 software revenue was $287 million, an increase of 9% year over year, despite a 900 basis point increase in the subscription mix compared to the same period last year. FY’18 software revenue was $1,088 million, an increase of 10% year over year, despite a 800 basis point increase in the subscription mix compared to the same period last year.

- Approximately 91% of fourth quarter software revenue came from recurring revenue streams, up from 85% in the same period last year.

- Annualized Recurring Revenue (ARR) was $1,012 million, an increase of 12% year over year and the seventh consecutive quarter of double-digit year-over-year growth.

- Billed deferred revenue increased 9% year over year to $499 million. Total deferred revenue – billed and unbilled - increased $318 million or 29% year over year. Billed and unbilled deferred revenue can fluctuate quarterly based upon the contractual billing dates in our recurring revenue contracts, the timing of our fiscal reporting periods, and Fx rates.

- GAAP operating margin in the fourth quarter was 4%, compared to 6% in the same period last year; non-GAAP operating margin was 21%, compared to 18% in the same period last year. FY’18 GAAP operating margin was 6%, compared to 4% in the same period last year; non-GAAP operating margin was 18%, compared to 16% in the same period last year.

- Operating cash flow in the fourth quarter was $62 million and free cash flow was $45 million. FY’18 operating cash flow was $248 million and free cash flow was $212 million, up 83% and 93%, respectively, compared to the same periods last year. Free cash flow includes cash payments of approximately $0.3 million for the fourth quarter and $3 million for FY’18 related to our past restructuring plans, compared to $2 million in Q4’17 and $37 million for FY’17.

- Total cash, cash equivalents, and marketable securities as of the end of the fourth quarter was $316 million and total debt, net of deferred issuance costs, was $643 million. During the fourth quarter, we repaid net $50 million of debt, and for FY’18, we repaid net $70 million of debt.

- In Q4’18, in connection with our strategic alliance with Rockwell Automation, we sold 10,582,010 shares of the Company’s Common Stock to Rockwell for approximately $1.0 billion. We used the proceeds from the Rockwell equity investment to repurchase shares of our common stock under a $1.0 billion accelerated share repurchase ("ASR") agreement with a major financial institution, of which $800 million worth of shares were delivered to us in Q4’18.

- With the growth opportunity in front of us in the Industrial Internet of Things and Augmented Reality, other strategic initiatives we’ve undertaken, and our continued commitment to operating margin improvement, we are realigning our workforce in the beginning of FY’19 to shift investment to support these strategic, high growth opportunities. This realignment will result in a restructuring charge of approximately $18 million in FY’19, which consists principally of termination benefits, substantially all of which we expect will be paid in FY’19. As this is a realignment of resources rather than a cost-savings initiative, we don’t expect this realignment will result in significant cost savings, and the effect of the realignment is reflected in our FY’19 guidance.

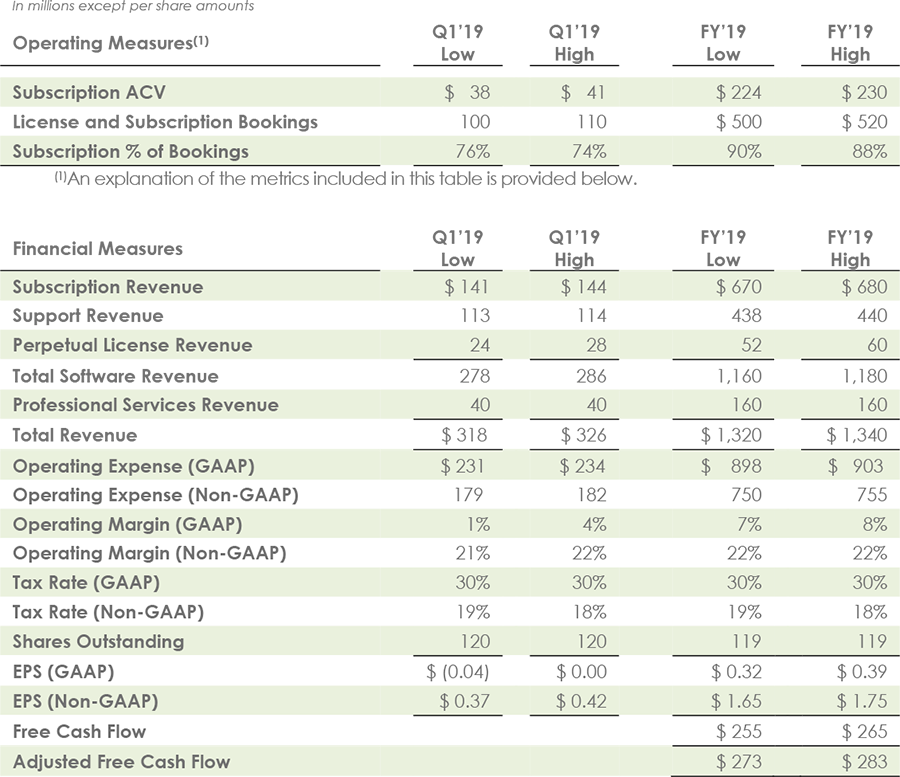

Fiscal 2019 Business Outlook - ASC 605

For the first quarter and fiscal year ending September 30, 2019, the company expects:

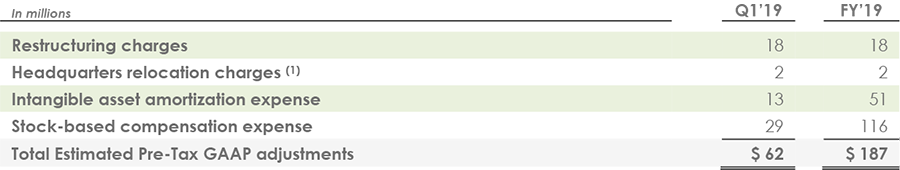

The first quarter and fiscal 2019 non-GAAP operating margin and non-GAAP EPS guidance exclude the estimated items shown in the table below, as well as any tax effects and discrete tax items (which are not known nor reflected). Adjusted free cash flow excludes $18 million of restructuring payments related to our workforce realignment plans.

(1) Represents accelerated depreciation expense recorded in anticipation of exiting our current headquarters facility. In 2019, we will be moving into a new worldwide headquarters in the Boston Seaport District and we will be vacating our current headquarters space. Because our current headquarters lease will not expire until November 2022, we are seeking to sublease that space, but have not yet done so. If we are unable to sublease our current headquarters space for an amount at least equal to our rent obligations under the current headquarters lease, we will bear overlapping rent obligations for those premises and will be required to record a charge related to such rent shortfall. We currently pay approximately $12 million in annual base rent and operating expenses for our current headquarters. We expect to record a charge for any such shortfall in the earlier of the period that we cease using the space (which will likely occur in the second quarter of our fiscal 2019) or the period we exit the lease contract. Additionally, we will incur other costs associated with the move which will be recorded as incurred.

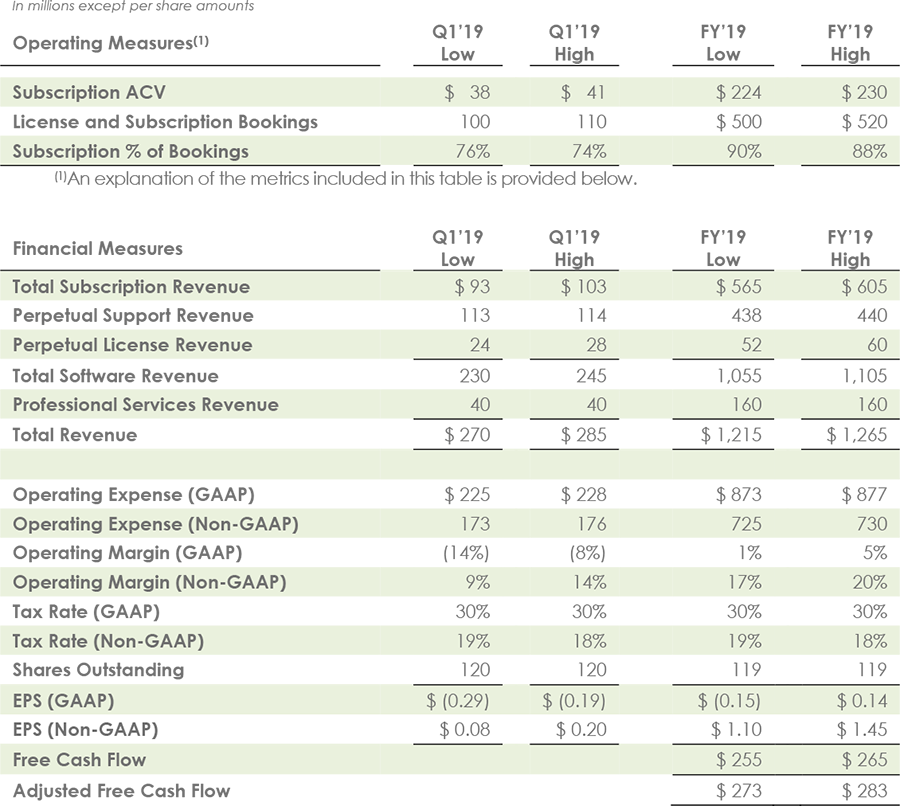

Fiscal 2019 Business Outlook - ASC 606

For the first quarter and fiscal year ending September 30, 2019, the company expects:

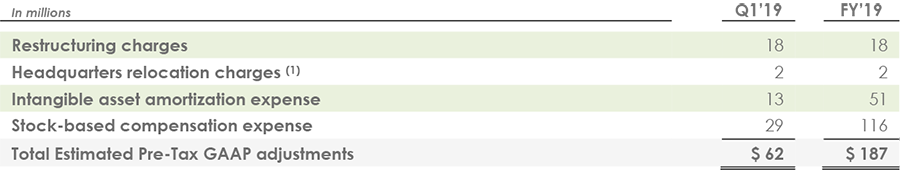

The first quarter and fiscal 2019 non-GAAP operating margin and non-GAAP EPS guidance exclude the estimated items outlined in the table below, as well as any tax effects and discrete tax items (which are not known nor reflected). Adjusted free cash flow excludes $18 million of restructuring payments related to our workforce realignment plans.

(1) Represents accelerated depreciation expense recorded in anticipation of exiting our current headquarters facility. In 2019, we will be moving into a new worldwide headquarters in the Boston Seaport District and we will be vacating our current headquarters space. Because our current headquarters lease will not expire until November 2022, we are seeking to sublease that space, but have not yet done so. If we are unable to sublease our current headquarters space for an amount at least equal to our rent obligations under the current headquarters lease, we will bear overlapping rent obligations for those premises and will be required to record a charge related to such rent shortfall. We currently pay approximately $12 million in annual base rent and operating expenses for our current headquarters. We expect to record a charge for any such shortfall in the earlier of the period that we cease using the space (which will likely occur in the second quarter of our fiscal 2019) or the period we exit the lease contract. Additionally, we will incur other costs associated with the move which will be recorded as incurred.

PTC’s Fiscal 2018 Fourth Quarter Results Conference Call, Prepared Remarks and Data Tables

Prepared remarks and financial data tables have been posted to the Investor Relations section of our website at ptc.com. The Company will host a management presentation to discuss results at 5:00 pm ET on Wednesday, October 24, 2018. To access the live webcast, please visit PTC’s Investor Relations website at investor.ptc.com at least 15 minutes before the scheduled start time to download any necessary audio or plug-in software. To participate in the live conference call, dial 773-799-3757 or 800-857-5592 and provide the passcode PTC. The call will be recorded and a replay will be available for 10 days following the call by dialing 866-358-4517 and entering the pass code 7910. The archived webcast will also be available on PTC’s Investor Relations website.

Bookings Metrics

We offer both perpetual and subscription licensing options to our customers, as well as monthly software rentals for certain products. Given the difference in revenue recognition between the sale of a perpetual software license (revenue is recognized at the time of sale) and a subscription (revenue is deferred and recognized ratably over the subscription term), we use bookings for internal planning, forecasting and reporting of new license and cloud services transactions. In order to normalize between perpetual and subscription licenses, we define subscription bookings as the subscription annualized contract value (subscription ACV) of new subscription bookings multiplied by a conversion factor of 2. We arrived at the conversion factor of 2 by considering a number of variables including pricing, support, length of term, and renewal rates. We define subscription ACV as the total value of a new subscription booking divided by the term of the contract (in days) multiplied by 365. If the term of the subscription contract is less than a year, and is not associated with an existing contract, the booking is equal to the total contract value. Beginning in Q3’18, minimum ACV commitments under our Strategic Alliance Agreement with Rockwell Automation are included in subscription ACV if the period-to-date minimum ACV commitment exceeds actual ACV sold under the Agreement.

License and subscription bookings equal subscription bookings (as described above) plus perpetual license bookings. Because subscription bookings is a metric we use to approximate the value of subscription sales if sold as perpetual licenses, it does not represent the actual revenue that will be recognized with respect to subscription sales or that would be recognized if the sales were perpetual licenses, nor does the annualized value of monthly software rental bookings represent the value of any such booking.

Total Deferred Revenue

Total Deferred Revenue consists of Billed Deferred Revenue and Unbilled Deferred Revenue. Unbilled deferred revenue is the aggregate of booked orders for license, support and subscription (including multi-year subscription contracts with start dates after October 1, 2018 that are subject to a limited annual cancellation right) for which the associated revenue has not been recognized and the customer has not been invoiced. We do not record Unbilled Deferred Revenue on our Consolidated Balance Sheet; we record such amounts as deferred revenue when we invoice the customer. Billed Deferred Revenue primarily relates to software agreements invoiced to customers for which the revenue has not yet been recognized. Billed deferred revenue can fluctuate quarterly based upon the contractual billing dates in our recurring revenue contracts, the timing of our fiscal reporting periods and Fx rates.

Software Revenue

Any reference to “total recurring software revenue” or “recurring software revenue” means the sum of subscription revenue and support revenue. Any reference to “total software revenue” or “software revenue” means the sum of subscription revenue, support revenue and perpetual license revenue. “Subscription revenue” includes cloud services revenue.

Navigate Allocation

Revenue and bookings for Navigate™, a ThingWorx-based IoT solution for PLM, are allocated 50% to Solutions and 50% to IoT.

Annualized Recurring Revenue (ARR)

To help investors understand and assess the success of our subscription transition, we provide an Annualized Recurring Revenue operating measure. Annualized Recurring Revenue (ARR) for a given quarter is calculated by dividing the portion of non-GAAP software revenue attributable to subscription and support for the quarter by the number of days in the quarter and multiplying by 365. (A related metric is Subscription ARR, which is calculated by dividing the portion of non-GAAP revenue attributable to subscription for the quarter by the number of days in the quarter and multiplying by 365.) ARR should be viewed independently of revenue and deferred revenue as it is an operating measure and is not intended to be combined with or to replace either of those items. ARR is not a forecast of future revenue, which can be impacted by contract expiration and renewal rates, and does not include revenue reported as perpetual license or professional services revenue in our consolidated statement of income. Subscription and support revenue and ARR disclosed in a quarter can be impacted by multiple factors, including but not limited to (1) the timing of the start of a contract or a renewal, including the impact of on-time renewals, support win-backs, and support conversions, which may vary by quarter, (2) the ramping of committed monthly payments under a subscription agreement over time, (3) multiple other contractual factors with the customer including other elements sold with the subscription or support contract, and (4) the impact of currency fluctuations. These factors can result in variability in disclosed ARR.

Constant Currency Change Metric

Year-over-year changes in revenue and bookings on a constant currency basis compare reported results excluding the effect of any hedging converted into U.S. dollars based on the corresponding prior year’s foreign currency exchange rates to reported results for the comparable prior year period.

Important Information About Non-GAAP References

PTC provides non-GAAP supplemental information to its financial results. We use these non-GAAP measures, and we believe that they assist our investors, to make period-to-period comparisons of our operational performance because they provide a view of our operating results without items that are not, in our view, indicative of our operating results. We believe that these non-GAAP measures help illustrate underlying trends in our business, and we use the measures to establish budgets and operational goals, communicated internally and externally, for managing our business and evaluating our performance. We believe that providing non-GAAP measures affords investors a view of our operating results that may be more easily compared to the results of peer companies. In addition, compensation of our executives is based in part on the performance of our business based on these non-GAAP measures. However, non-GAAP information should not be construed as an alternative to GAAP information as the items excluded from the non-GAAP measures often have a material impact on PTC’s financial results and such items often recur. Management uses, and investors should consider, non-GAAP measures in conjunction with our GAAP results.

Non-GAAP revenue, non-GAAP operating expense, non-GAAP operating margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income and non-GAAP EPS exclude the effect of the following items: a revenue write-down and revenue associated with the settlement of a previously disclosed disputed customer receivable, fair value of acquired deferred revenue, fair value adjustment to deferred services cost, stock-based compensation, amortization of acquired intangible assets, acquisition-related and other transactional charges included in general and administrative costs, restructuring charges, headquarters relocation charges, and income tax adjustments.

Settlement Revenue Exclusions. In Q4'18, we settled a previously disclosed dispute with respect to a customer receivable. The settlement included partial payment of the receivable and new software purchases. The net revenue write-down recorded in Q4'18 was $9.3 million, comprised of a $14.5 million professional services revenue write-down, partially offset by new subscription revenue of $5.2 million. We excluded the professional services revenue write-down because the write-down related to revenue that was recorded in periods prior to CY17 and is not reflective of current operating performance and excluded the new subscription revenue because it mitigated the impact of the professional services revenue write-down.

Additional information about the items we exclude from our non-GAAP financial measures and the reasons we exclude them can be found in “Non-GAAP Financial Measures” beginning on page 33 of our Annual Report on Form 10-K for the fiscal year ended September 30, 2017.

A reconciliation of non-GAAP measures to GAAP results is provided within this press release.

PTC also provides information on “free cash flow” and “adjusted free cash flow” to enable investors to assess our ability to generate cash without incurring additional external financings and to evaluate our performance against our announced long-term goal of returning approximately 40% of our free cash flow to shareholders via stock repurchases. Free cash flow is net cash provided by (used in) operating activities less capital expenditures; adjusted free cash flow is free cash flow excluding restructuring payments and certain identified non-ordinary course payments. Free cash flow and adjusted free cash flow are not measures of cash available for discretionary expenditures.

Forward-Looking Statements

Statements in this press release that are not historic facts, including statements about our first quarter and full fiscal 2019 targets, and other future financial and growth expectations and targets and anticipated tax rates, are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected. These risks include: the macroeconomic and/or global manufacturing climates may deteriorate; customers may not purchase our solutions or convert existing support contracts to subscription when or at the rates we expect; our businesses, including our Internet of Things (IoT) business, and Augmented Reality businesses, may not expand and/or generate the revenue we expect; foreign currency exchange rates may vary from our expectations and thereby affect our reported revenue and expense; the mix of revenue between license & subscription solutions, support and professional services could be different than we expect, which could impact our EPS results; our transition to subscription-only licensing could adversely affect sales and revenue; sales of our solutions as subscriptions may not have the longer-term effect on revenue and earnings that we expect; bookings associated with minimum ACV commitments under our Strategic Alliance Agreement with Rockwell Automation may not result in subscription contracts sold through to end-user customers; our strategic initiatives and investments may not generate the revenue we expect; we may be unable to expand our partner ecosystem as we expect and our partners may not generate the revenue we expect; we may be unable to generate sufficient operating cash flow to return 40% of free cash flow to shareholders and other uses of cash or our credit facility limits or other matters could preclude share repurchases. In addition, our assumptions concerning our future GAAP and non-GAAP effective income tax rates are based on estimates and other factors that could change, including the geographic mix of our revenue, expenses and profits. Other risks and uncertainties that could cause actual results to differ materially from those projected are detailed from time to time in reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

PTC and the PTC logo are trademarks or registered trademarks of PTC Inc. or its subsidiaries in the United States and in other countries.

About PTC (NASDAQ: PTC)

PTC helps companies around the world reinvent the way they design, manufacture, operate, and service things in and for a smart, connected world. In 1986 we revolutionized digital 3D design, and in 1998 were first to market with Internet-based product lifecycle management. Today, our leading industrial innovation platform and field-proven solutions enable you to unlock value at the convergence of the physical and digital worlds. With PTC, manufacturers and an ecosystem of partners and developers can capitalize on the promise of the Internet of Things and augmented reality technology today and drive the future of innovation.