PTC Announces Fiscal Fourth Quarter 2021 and Full Year 2021 Results

Strong ARR, Revenue, EPS, and Cash Flow Performance for the Fourth Quarter and Full Year

BOSTON, MA, November 3, 2021 - PTC (NASDAQ: PTC) today reported financial results for its fiscal fourth quarter and full year ended September 30, 2021.

“Our performance in 2021 reflects strong execution against the financial guidance we set at the beginning of our fiscal year. Capped by an outstanding fourth quarter, in fiscal 2021 we delivered our fourth consecutive year of double-digit organic ARR growth, while also delivering operating cash flow growth of 58% and free cash flow growth in excess of 60%,” said James Heppelmann, President and CEO, PTC.

“In Q4 and throughout the year we saw growth across all product segments and geographies. Our Core CAD and PLM products continued to outpace market growth, and the strong performance of our Onshape and Arena businesses reflects the growing momentum for cloud-native SaaS technologies in the industrial software market,” continued Heppelmann.

“Building on a track record of solid financial performance and market leading technology, we are accelerating our SaaS transition timeline by implementing key initiatives that better align us to SaaS best practices, including reorganizing our customer success organization and combining product development, delivery, and support under one umbrella. We are also incrementally investing in our Atlas platform, the SaaS transition of our Core CAD and PLM products, and product and go-to-market initiatives for our cloud-native Onshape and Arena businesses. These changes enable PTC to accelerate the transition to SaaS across our portfolio, begin moving our on-premise customers to SaaS offerings sooner than previously contemplated, and expand contribution margins. These moves enhance PTC’s ability to support customers and deliver strong top-line growth coupled with strong free cash flow, expanding our opportunity to deliver shareholder value over the long-term,” concluded Heppelmann.

Fourth quarter and full year 2021 highlights[1]

Key operating and financial highlights are set forth below. For additional details, please refer to the Q4’21 earnings presentation and financial data tables that have been posted to the Investor Relations section of our website at investor.ptc.com.

- ARR

was $1.47 billion at the end of Q4’21 and FY’21, representing growth of 16%, and 16% in constant currency, compared to Q4’20 and FY’20. Organic growth was 11% as of the end of Q4’21, or 12% in constant currency, compared to Q4’20.

- Cash flow from operations was $45 million and free cash flow was $32 million in Q4’21, compared to Q4’20 cash flow from operations of $34 million and free cash flow of $29 million. For FY’21, cash flow from operations was $369 million and free cash flow was $344 million, compared to FY’20 cash flow from operations of $234 million and free cash flow of $214 million.

- Revenue was $481 million in Q4’21 compared to $391 million in Q4’20, growth of 23%, or 21% in constant currency, and revenue for FY’21 was $1,807 million compared to $1,458 million in FY’20, growth of 24%, or 20% in constant currency, driven primarily by strong execution, as well as the impact of up-front license revenue recognition under ASC 606, and a modest contribution from Arena.

- Operating margin was 24% in Q4’21, compared to 17% in Q4’20. Non-GAAP operating margin in Q4’21 was 37%, compared to 32% in Q4’20. For FY’21, operating margin was 21%, compared to 14% in FY’20, and non-GAAP operating margin was 35%, compared to 29% in FY’20.

- Earnings per share was $2.46 in Q4’21, compared to $0.46 in Q4’20. Non-GAAP earnings per share in Q4’21 was $1.10 compared to $0.78 in Q4’20. For FY’21, earnings per share was $4.03, compared to $1.12 in FY’20, and non-GAAP earnings per share was $3.97 compared to $2.57 in FY’20. The increase in EPS is due to solid execution, as well as a $69 million gain on our investment in Matterport, Inc. recorded in Q4’21 and a $137 million release in Q4’21 of our U.S. valuation allowance as we will be more likely than not to realize the majority of our deferred tax assets in the U.S.

- Total cash and cash equivalents as of the end of Q3’21 was $366 million; gross debt was $1.5 billion. We repaid $30 million on our revolver in Q3’21.

- Stock repurchases were $30 million in Q4’21.

- 1We include operating and non-GAAP financial measures in our operational highlights. The detailed definitions of these items and reconciliations of Non-GAAP financial measures to comparable GAAP measures are included below and in the reconciliation tables at the end of this press release.

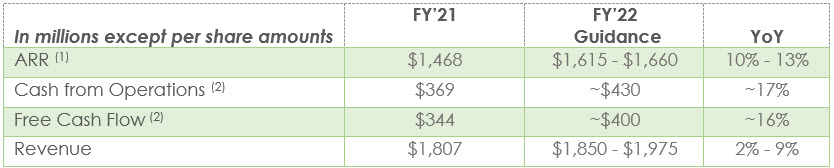

Fiscal 2022 Guidance

“PTC again delivered fourth quarter and full-year 2021 financial results in line with or exceeding the guidance we established at the beginning of the year,” said Kristian Talvitie, EVP and CFO, PTC. “The accelerated reorganization and investments we are undertaking this year are designed to better align PTC to our SaaS future and are expected to de-risk our path towards delivering on our mid-term cash flow targets. Accordingly, we will record a $45 to $50 million restructuring charge in Q1. On a go-forward basis, our operating model will be more scalable, resulting in a sustained higher cash contribution margin. We expect to deliver ARR growth of 10% to 13%, approximately $430 million of cash from operations and approximately $400 million of Free Cash Flow, including approximately $50 million of restructuring payments in FY22.”

(1) FY21 ARR recast at FY22 Plan Fx, and excludes certain Vuforia amounts.

(2) FY’21 cash from operations and free cash flow include $14.5 million of restructuring payments, $15.0 million of acquisition-related payments, and $17.9 million in un-forecasted payments related to the prior period tax exposure from a non-U.S. tax dispute. The FY’22 cash from operations and free cash flow guidance include expected restructuring payments of approximately $50 million - $55 million.

Our FY’22 financial guidance includes the assumptions below:

- We assume the current macro environment to remain consistent H1’22, beginning to moderate in H2’22.

- ARR growth is expected to be approximately 15% in Q1’22, stronger than in the remainder of fiscal ‘22, since Q1’21 did not include ARR for Arena, which was acquired in Q2‘21. From Q2 through Q4 of fiscal ’22, we expect approximately linear performance, with consistent year-over-year growth rates.

- We expect churn to improve by approximately 100 basis points over FY’21.

- At the mid-point of ARR guidance, we expect GAAP operating expenses to increase approximately 4-5% and non-GAAP operating expense to increase approximately 2-3%.

- Costs are expected to ramp throughout the year due to hiring and increased SaaS investments.

- Total estimated pre-tax adjustments of $275 million - $280 million outlined below, as well as any additional tax effects and discrete tax items (which are not known or reflected).

- $58 million intangible asset amortization expense

- $172 million stock-based compensation expense

- $45-50 million restructuring and other charges.

- Fluctuations in the value of our Matterport investment are excluded from both GAAP and non-GAAP guidance.

- Related to the restructuring, we expect:

- P&L charges of approximately $45 million to $50 million, primarily in Q1’22.

- Cash outflows for restructuring payments of approximately $50 million to $55 million, with approximately two-thirds occurring in H1’22 and the majority of the remaining payments in Q3’22.

- Capital expenditures are expected to be approximately $30 million.

- In FY’22, our GAAP tax rate is expected to be approximately 20% and our non-GAAP tax rate is expected to be approximately 19%.

- We target to return approximately 25% of our free cash flow excluding restructuring payments to our shareholders through share repurchases, as we continue to rapidly de-lever. After de-levering, we would expect to resume returning 50% of our FCF to shareholders through share repurchases.

PTC’s Fiscal Fourth Quarter and Full Year 2021 Results Conference Call

The Company will host a conference call to discuss results at 5:00 pm ET on Wednesday, November 3, 2021.

To participate in the live conference call, dial (888) 330-2384 or (240) 789-2701and provide the passcode 4098724, or log in to the webcast, available on PTC’s Investor Relations website. A replay will also be available.

Important Disclosures

Important Information About Our Non-GAAP Financial Measures

PTC provides supplemental non-GAAP financial measures to its financial results. We use these non-GAAP financial measures, and we believe that they assist our investors, to make period-to-period comparisons of our operating performance because they provide a view of our operating results without items that are not, in our view, indicative of our operating results. These non-GAAP financial measures should not be construed as an alternative to GAAP results as the items excluded from the non-GAAP financial measures often have a material impact on our operating results, certain of those items are recurring, and others often recur. Management uses, and investors should consider, our non-GAAP financial measures only in conjunction with our GAAP results.

Non-GAAP operating expense, non-GAAP operating margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income and non-GAAP EPS exclude the effect of the following items: stock-based compensation; amortization of acquired intangible assets; acquisition-related and other transactional charges included in general and administrative expenses; restructuring and other charges, net; certain non-operating charges; and income tax adjustments. Additional information about the items we exclude from our non-GAAP financial measures and the reasons we exclude them can be found in “Non-GAAP Financial Measures” on page 25 of our Annual Report on Form 10-K for the fiscal year ended September 30, 2020. In FY’21, we incurred tax expense related to a South Korean tax matter which is excluded from our non-GAAP financial measures as it is related to prior periods and not included in management’s view of results for comparative purposes. We also recorded a tax benefit in FY’21 related to the release of our U.S. valuation allowance as a result of the Arena acquisition and our conclusion that it is now more likely than not that we will realize the majority of our deferred tax assets in the U.S. As the non-GAAP tax provision is calculated assuming that there is no valuation allowance, this benefit has been excluded from our non-GAAP financial measures.

Free Cash Flow - PTC provides information on free cash flow to enable investors to assess our ability to generate cash without incurring additional external financings and to evaluate our performance against our announced long-term goals and intent to return approximately 50% of our free cash flow to shareholders via stock repurchases. Free cash flow is net cash provided by (used in) operations net of capital expenditures. Free cash flow is not a measure of cash available for discretionary expenditures.

Constant Currency (CC) Change Metric - We present CC information to provide a framework for assessing how our underlying business performed excluding the effects of foreign currency rate fluctuations. To present CC information, FY21 and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars using the foreign exchange rate as of September 30, 2020, rather than the actual exchange rates in effect during that period. All discussion of FY22 and comparative prior period ARR results (including FY21 baseline amounts) are reflected using the foreign exchange rates as of September 30, 2021.

Operating Measures

ARR - To help investors understand and assess the performance of our business as a SaaS and on-premise subscription company we provide an ARR (Annual Run Rate) operating measure. ARR represents the annualized value of our portfolio of active subscription software, cloud, SaaS, and support contracts as of the end of the reporting period. ARR includes orders placed under our Strategic Alliance Agreement with Rockwell Automation, including orders placed to satisfy contractual minimum commitments.

We believe ARR is a valuable operating metric to measure the health of a subscription business because it captures expected subscription and support cash generation from customers.

Forward-Looking Statements

Statements in this press release that are not historic facts, including statements about our future financial and growth expectations and targets, and potential stock repurchases, are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected. These risks include: the macroeconomic and/or global manufacturing climates may not improve when or as we expect, or may deteriorate, due to, among other factors, the COVID-19 pandemic, which could cause customers to delay or reduce purchases of new software, reduce the number of subscriptions they carry, or delay payments to us, all of which would adversely affect ARR and our financial results, including cash flow; our businesses, including our SaaS businesses, may not expand and/or generate the revenue or ARR we expect if customers are slower to adopt our technologies than we expect or if they adopt competing technologies; our strategic initiatives and investments, including our restructuring and our accelerated investments in our transition to SaaS, may not deliver the results when or as we expect; we may be unable to generate sufficient operating cash flow to repay amounts under our credit facility or to return 50% of free cash flow to shareholders, and other uses of cash or our credit facility limits or other matters could preclude such repayment and/or repurchases; foreign exchange rates may differ materially from those we expect; and orders associated with minimum commitments under our Strategic Alliance Agreement with Rockwell Automation may not result in subscription contracts sold through to end-user customers, which could cause the ARR associated with those orders to churn. In addition, our assumptions concerning our future GAAP and non-GAAP effective income tax rates are based on estimates and other factors that could change, including the geographic mix of our revenue, expenses, and profits. Other risks and uncertainties that could cause actual results to differ materially from those projected are detailed from time to time in reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

About PTC (NASDAQ: PTC)

PTC unleashes industrial innovation with award-winning, market-proven solutions that enable companies to differentiate their products and services, improve operational excellence, and increase workforce productivity. With PTC and its partner ecosystem manufacturers can capitalize on the promise of today’s new technology to drive digital transformation.

PTC Investor Relations Contacts

Matt Shimao

SVP, Investor Relations

[email protected]

[email protected]