PTC Announces Fourth Quarter Fiscal Year 2019 Results

Revenue, Operating Margin and EPS Exceed Guidance; Completes Subscription Transition; Raises Revenue and Free Cash Flow Guidance

BOSTON, MA, Oct 23, 2019 - PTC (NASDAQ: PTC) today reported financial results for its fiscal fourth quarter and fiscal year ended September 30, 2019.

James Heppelmann, President and CEO said “PTC’s ARR grew 12% in fiscal 2019 reflecting the strength of our technology in the markets we serve and the value we provide to our customers. We also successfully completed the transition to subscription licensing and ended the year strong across key financial metrics including revenue and margins.”

Heppelmann added, “Today, we also announced PTC’s intention to acquire Onshape, creators of the first SaaS product development platform that unites next-generation CAD, data management, and collaboration tools. Onshape’s proven talent and technology are the perfect complement to PTC’s market leading on-premise CAD and PLM solutions, and will dramatically strengthen PTC’s ability to participate in the highest growth part of the market with a unique SaaS-based product offering. Most importantly, Onshape will put PTC in a position to lead the market’s inevitable shift to SaaS.”

Fourth quarter and fiscal year 2019 highlights1

Additional operating and financial highlights are set forth below. For additional details, please refer to the prepared remarks and financial data tables that have been posted to the Investor Relations section of our website at [email protected]. Note that all references to revenue and margins are under ASC 605.

- License and subscription bookings in Q4’19 were $150 million, $5 million above the high end of our guidance range driven by strong bookings in IoT and AR, including a mega deal with our strategic alliance partner Rockwell Automation. FY’19 license and subscription bookings were $472 million, up 1% year over year or 4% on a constant currency basis.

- ARR per the new definition was $1,116 million, or $1,134 million at the guidance Fx rate, at the end of Q4’19, in line with the targets we provided in September. This is a 10% increase, or 12% increase consistent with the guidance rate, compared to Q4’18, reflecting the strength of our recurring revenue business.

- Operating cash flow was $55 million in Q4’19; FY’19 operating cash flow was $285 million. FY’19 free cash flow was $221 million and adjusted free cash flow was $245 million, increases of 4% and 13%, respectively, over Q4’18. FY’19 adjusted free cash flow excludes $25 million of restructuring payments related to our workforce realignment and headquarters relocation.

- We include operating and non-GAAP financial measures in our operational highlights. We revised the definition of ARR on September 5, 2019. The detailed definitions of these items and reconciliations of Non-GAAP financial measures to comparable GAAP measures are included below and in the reconciliation tables at the end of this press release.

- The mega deal from Rockwell Automation was issued to satisfy a portion of expected FY20 demand and will be credited against committed ACV minimums due in FY20 under the parties’ strategic alliance agreement, as amended. Excluding the mega deal, bookings for the quarter were within the guidance range.

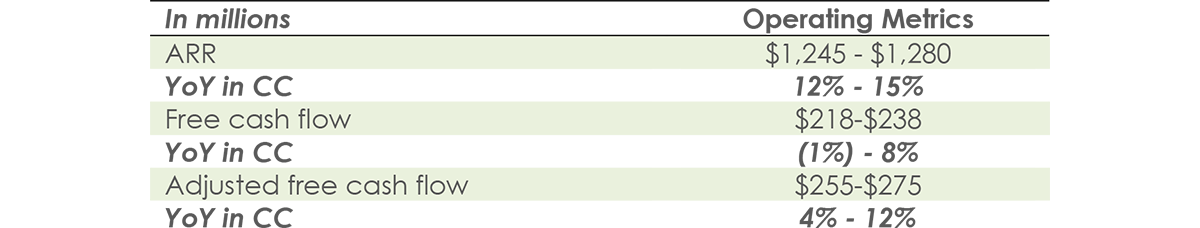

Fiscal 2020 Operational Outlook

Our fiscal 2020 operational outlook includes the following general considerations:

- ARR guidance:

- Allows for potential impact of moderate weakening of macroeconomic conditions

- Onshape contribution of approximately 100 bps of incremental growth

- Contribution from ramp deals and deals with FY’20 start dates

- Modest improvement to churn

- FCF and adjusted FCF guidance reflects:

- Operating cash flow of $248M - $268M

- $30M of Capex

- $37M of restructuring and headquarters relocation charges

- Short-term impacts of $65M including:

- $25M of incremental interest expense related to the Onshape acquisition

- $25M of higher cash taxes driven by the timing of ASC606 revenue recognition

- $15M of negative impact due to Fx

Fiscal 2020 Financial Outlook

Our fiscal 2020 financial outlook includes the following general considerations:

- The Onshape acquisition (excluding the impact of purchase accounting and acquisition-related costs).

- Operating expenses are expected to grow roughly 9%, slightly elevated due to the Onshape acquisition. We expect the run-rate to decline in the back half of FY’20.

3 We plan to increase the revolving credit facility from $700 million to $1 billion in FY’20.

4 Adjusted free cash flow excludes $37 million of estimated restructuring payments related primarily to our workforce realignment associated with expected synergies and operational efficiencies related to the Onshape acquisition, and headquarters relocation

- Allows for potential impact of moderate weakening of macroeconomic conditions

- Based on Fx rates as of September 30, 2019.

- Sharecount will be roughly flat compared to FY’19. We are suspending the share repurchase program for one year to accelerate debt repayment.

- ASC 606 creates quarterly and annual volatility for on-premise subscription companies due to factors that affect revenue recognition such as:

- Term length for new and renewal bookings

- Contract start-date timing

- Quarterly spread of new and renewal bookings

- Support to subscription conversions

- Potential future changes to revenue recognition for certain products as they become further cloud enabled

As such, we are providing a wide range on revenue and EPS.

For fiscal year ending September 30, 2020, the company expects:

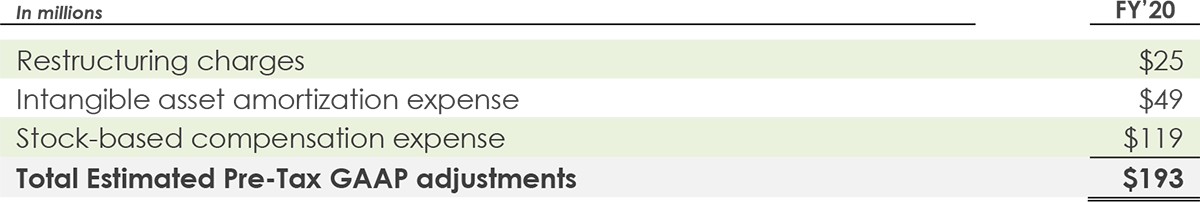

(1) The FY’20 non-GAAP revenue and non-GAAP EPS guidance exclude the estimated items outlined in the table below, as well as any tax effects and discrete tax items (which are not known nor reflected).

Estimates for the effect of acquisition accounting on fair value of acquired deferred revenue, intangible amortization and acquisition-related charges related primarily to the Onshape acquisition are not reflected in the FY’20 revenue and EPS guidance table above.

PTC’s Fiscal Fourth Quarter Results Conference Call, Prepared Remarks and Data Tables

Prepared remarks and financial data tables have been posted to the Investor Relations section of our website at ptc.com. The Company will host a conference call to discuss results at 5:00 pm ET on Wednesday, October 23, 2019. To access the live webcast, please visit PTC’s Investor Relations website at investor.ptc.com at least 15 minutes before the scheduled start time to download any necessary audio or plug-in software. To participate in the live conference call, dial 773-799-3757 or 800-857-5592 and provide the passcode PTC. The call will be recorded, and a replay will be available for 10 days following the call by dialling 800-873-2012 and entering the passcode 9752. The archived webcast will also be available on PTC’s Investor Relations website.

Important Disclosures

Important Information About Our Operating and Non-GAAP Financial Measures

PTC provides non-GAAP supplemental information to its financial results. We use these non-GAAP measures, and we believe that they assist our investors, to make period-to-period comparisons of our operational performance because they provide a view of our operating results without items that are not, in our view, indicative of our operating results. We believe that these non-GAAP measures help illustrate underlying trends in our business, and we use the measures to establish budgets and operational goals, communicated internally and externally, for managing our business and evaluating our performance. We believe that providing non-GAAP measures affords investors a view of our operating results that may be more easily compared to the results of peer companies. In addition, compensation of our executives is based in part on the performance of our business based on these non-GAAP measures. However, non-GAAP information should not be construed as an alternative to GAAP information as the items excluded from the non-GAAP measures often have a material impact on our financial results and such items often recur. Management uses, and investors should consider, non-GAAP measures in conjunction with our GAAP results.

Non-GAAP revenue, non-GAAP operating expense, non-GAAP operating margin, non-GAAP gross profit, non-GAAP gross margin, non-GAAP net income and non-GAAP EPS exclude the effect of the following items: fair value of acquired deferred revenue, fair value adjustment to deferred services cost, stock-based compensation, amortization of acquired intangible assets, acquisition-related and other transactional charges included in general and administrative costs, restructuring and headquarters relocation charges, and income tax adjustments. Additional information about the items we exclude from our non-GAAP financial measures and the reasons we exclude them can be found in “Non-GAAP Financial Measures” of our Annual Report on Form 10-K for the fiscal year ended September 30, 2018.

Free Cash Flow and Adjusted Free Cash Flow - PTC also provides information on “free cash flow” and “adjusted free cash flow” to enable investors to assess our ability to generate cash without incurring additional external financings and to evaluate our performance against our announced long-term goal of returning approximately 50% of our free cash flow to shareholders via stock repurchases. Free cash flow is net cash provided by (used in) operating activities less capital expenditures; adjusted free cash flow is free cash flow excluding restructuring payments and certain identified non-ordinary course payments. Free cash flow and adjusted free cash flow are not measures of cash available for discretionary expenditures.

Constant Currency Change Metric - Year-over-year changes in revenue and bookings on a constant currency basis compare reported results excluding the effect of any hedging converted into U.S. dollars based on the corresponding prior year’s foreign currency exchange rates to reported results for the comparable prior year period.

Operating Measures

ARR

To help investors understand and assess the success of our subscription transition, we provide an ARR operating measure. On September 5, 2019, we revised the ARR definition. ARR represents the annualized value of our portfolio of recurring customer arrangements as of the end of the reporting period, including subscription software, cloud, and support contracts. This is a change from our prior definition where ARR for a quarter was calculated by dividing the portion of non-GAAP software revenue attributable to subscription and support under ASC 605 for the quarter by the number of days in the quarter and multiplying by 365.

We believe ARR is a valuable operating metric to measure the health of a subscription business because it captures expected subscription and support cash generation from new customers, existing customer expansions and includes the impact of churn (gross churn net of pricing).

Because this measure represents the annualized value of recurring customer contracts as of the end of a reporting period, ARR does not represent revenue for any particular period or remaining revenue that will be recognized in future periods.

New Subscription Annualized Contract Value (ACV)

New subscription ACV includes new subscription and support ARR from existing customer expansions and from new customers.

Churn

Churn is gross churn net of pricing, it does not include upsell and cross sell.

Cash Generation

Cash generation is ARR plus perpetual license revenue and professional services revenue.

Cost of Revenue

Cost of revenue includes cost of license, cost of support and cloud services, and cost of professional services.

Software Revenue

Any reference to “total recurring software revenue” or “recurring software revenue” means the sum of subscription revenue and support revenue. Any reference to “total software revenue” or “software revenue” means the sum of subscription revenue, support revenue and perpetual license revenue. “Subscription revenue” includes cloud services revenue.

Navigate Allocation

Revenue and bookings for the Navigate™ ThingWorx-based IoT solution for PLM are allocated 50% to Solutions and 50% to IoT.

Foreign Currency Impacts on our Business

We have a global business, with Europe and Asia historically representing approximately 60% of our revenue, and fluctuation in foreign currency exchange rates can significantly impact our results. We do not forecast currency movements; rather we provide detailed constant currency commentary.

Bookings Metrics

On Sept 5, 2019 we announced a revision to our reporting measures. We will no longer provide bookings but instead will provide ARR, which we believe provides a more comprehensive view of a subscription business. We offer both perpetual and subscription licensing options to our customers, as well as monthly software rentals for certain products. Given the difference in revenue recognition between the sale of a perpetual software license and a subscription, we use bookings for internal planning, forecasting and reporting of new license and cloud services transaction (as subscription bookings includes cloud services bookings).

In order to normalize between perpetual and subscription licenses, we define subscription bookings as the subscription annualized contract value (subscription ACV) of new subscription contracts multiplied by a conversion factor of 2. We arrived at the conversion factor of 2 by considering a number of variables including pricing, support, length of term, and renewal rates. We define subscription ACV as the total value of a new subscription contract (which may include annual values that increase over time) divided by the term of the contract (in days) multiplied by 365. If the term of the subscription contract is less than a year, and is not associated with an existing contract, the booking is equal to the total contract value. Beginning in Q3’18, minimum ACV commitments under our Strategic Alliance Agreement with Rockwell Automation are included in subscription ACV if the period-to-date minimum ACV commitment exceeds actual ACV sold under the Agreement.

License and subscription bookings equal subscription bookings (as described above) plus perpetual license bookings. Because subscription bookings is a metric we use to approximate the value of subscription sales if sold as perpetual licenses, it does not represent the actual revenue that will be recognized with respect to subscription sales or that would be recognized if the sales were perpetual licenses, nor does the annualized value of monthly software rental bookings represent the value of any such booking.

Forward-Looking Statements

Statements in this press release that are not historic facts, including statements about our future financial and growth expectations and targets, are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected. These risks include: the macroeconomic and/or global manufacturing climates may deteriorate due to, among other factors, the geopolitical environment, including the focus on technology transactions with non-U.S. entities and potential expanded prohibitions, and ongoing trade tensions and tariffs; our businesses, including our Internet of Things (IoT) and Augmented Reality businesses, may not expand and/or generate the revenue we expect if customers are slower to adopt those technologies than we expect or adopt competing technologies; bookings associated with minimum ACV commitments under our Strategic Alliance Agreement with Rockwell Automation may not result in subscription contracts sold through to end-user customers; the Onshape acquisition may not close when or as we expect and may not provide the competitive benefit we expect; we may be unable to generate sufficient operating cash flow to repay the Onshape debt when or as we expect or to return 50% of free cash flow to shareholders and other uses of cash or our credit facility limits or other matters could preclude such repayments or share repurchases; we may be unable to expand our outstanding credit facility as we expect, which could adversely affect our liquidity and our credit rating; we may be unable to expand our partner ecosystem as we expect; and our partners may not generate the revenue we expect. In addition, our assumptions concerning our future GAAP and non-GAAP effective income tax rates are based on estimates and other factors that could change, including the geographic mix of our revenue, expenses and profits. Other risks and uncertainties that could cause actual results to differ materially from those projected are detailed from time to time in reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

About PTC (NASDAQ: PTC)

PTC unleashes industrial innovation with award-winning, market-proven solutions that enable companies to differentiate their products and services, improve operational excellence, and increase workforce productivity. With PTC, and its partner ecosystem, manufacturers can capitalize on the promise of today’s new technology to drive digital transformation.

PTC Q4 FY'19 Earnings Press Release Tables (PDF)