David Immerman is as a Consulting Analyst for the TMT Consulting team based in Boston, MA. Prior to S&P Market Intelligence, David ran competitive intelligence for a supply chain risk management software startup and provided thought leadership and market research for an industrial software provider. Previously, David was an industry analyst in 451 Research’s Internet of Things channel primarily covering the smart transportation and automotive technology markets.

Sustainability initiatives are growing in importance for manufacturers. According to 451 Research's Voice of the Enterprise (VotE) Macroeconomic Outlook Business Trends, ESG 2021 and 2022 studies, 35% of manufacturers claimed a formal ESG program either in place or in active planning in 2022, up from 23% in 2021. Identifying exactly what is driving sustainability efforts for manufacturers can provide pivotal program guidance, since these drivers differ from other industries.

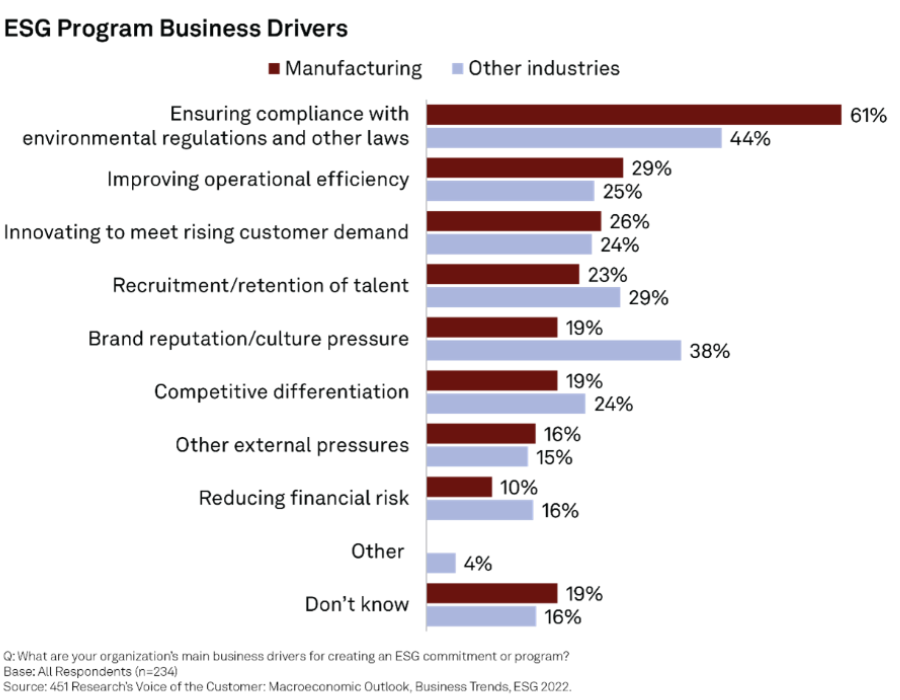

In the 2022 VotE study, there were a few areas where manufacturers ranked higher than other surveyed industries when asked about the main business drivers for creating an ESG program.

- 61% of manufacturers cite ensuring compliance with environmental regulations and other laws as a significant factor, compared with just 44% in other industries.

- 29% of manufacturers are looking to improve operational efficiency with an ESG program.

- 26% claim innovating to meet rising customer demand as a main driver for ESG efforts.

These survey results show that manufacturers have three notable focus areas when it comes to their sustainability initiatives. Below we examine these top drivers of ESG efforts among manufacturing respondents.

1. Ensure compliance with current and future regulations

Existing and emerging environmental regulations being pushed by regulators present sizable risks to manufacturers' operations. The consequences of not complying with these requirements can range from stiff penalties to ceased operations, lawsuits, and possibly the biggest financial impact — loss of consumer trust. Simply put, the need to comply with environmental regulations is too severe to ignore, making it table stakes for sustainable manufacturing, and a common starting place for manufacturers to target.

Many industry-specific regulatory rulings have been instrumental in manufacturers' operations and decision-making for several years now. In the U.S., the EPA has outlined laws, regulations and guidelines in manufacturing verticals — these include air pollution controls and metal finishing in automotive and surface coating of metal cans/coils and engine test cells in aerospace, among many other examples. While some regulations have been primarily viewed as just a cost of doing business, their strategic implications are increasing as sustainable manufacturing grows (e.g., California ruling to phase out new sales of gasoline-powered vehicles by 2035).

Scope 1, 2, and 3 emissions are emerging as key sustainability disclosure standards and future regulatory frameworks for businesses to measure, monitor, report and disclose as climate-related risks and sustainability metrics.

- Scope 1 emissions are primarily concerned with the direct output of a company's operations.

- Scope 2 refers to the "indirect" emissions output of these operations from the energy used (electricity, heating/cooling) to power them.

- Scope 3 emissions encompass activities across the supply chain, including upstream processes (leased assets, business travel, employees commuting, capital goods) and downstream practices (processing/use of sold products, end-of-life treatment, investments). According to S&P Global Trucost, Scope 3 emissions can account for as much as 84% of greenhouse gas emissions at some companies.

With Scope 3 emissions, the broader supply chain will be increasingly in focus for manufacturers. This means procuring materials that are less detrimental to the environment and sourcing parts from ethical, reputable and local suppliers. Manufacturers are assuming more responsibility post-manufacturing and further downstream with their products operating in customer environments.

There are likely multiple technologies needed to enable these expansive and demanding sustainability drivers and to ensure compliance. Manufacturers should aim to sync sustainability initiatives with digital transformation programs that provide the structure to alleviate regulatory concerns and get in front of future ones.

2. Efficiency and sustainability: A possible “win-win”

Manufacturers used to operating on razor-thin profit margins prioritize optimizing activities that impact costs. These could include worker inefficiencies stemming from rework, downtime or excess energy usage from malfunctioning/deteriorating equipment, as well as more scrap and waste from overuse of materials.

Operating more efficiently in manufacturing production facilities can be a "win-win" for the environment and profit margins. An example here could be improving the universal manufacturing metric, overall equipment effectiveness (OEE), which measures availability, performance and quality. 451 Research's VotE: Internet of Things survey research indicates that three-quarters of companies have an OEE of less than 80%, where 85% is commonly considered the ideal state, or "best in class." This means for most organizations there is room to improve OEE, and this impact can intersect with sustainability in the following areas:

- Availability: Better optimizing machines' scheduling and maximizing their capacity can increase energy efficiency across the production line.

- Performance: Reducing micro-stoppages improves cycle times and run rates while limiting any inefficient production time, which can reduce power consumption.

- Quality: Reducing defects and correlated rework in production processes also decreases the amount of scrap and waste.

Manufacturers can simultaneously improve both costly operational efficiency KPIs such as OEE and sustainability metrics as they impact one another.

3. Innovating to meet growing customer demands

In both B2B and B2C scenarios, customers are demanding more innovative and sustainable products. In B2B, businesses are looking across their supply chain for more sustainable materials, parts, products and services. For B2C, consumer sentiment is shifting toward prioritizing ethically and socially responsible brands, for which sustainability is a key ingredient.

As with most product decisions, making more innovative and sustainable products typically starts in the engineering and product development departments. Designing for environmental impact is an emerging use case that is helping manufacturers drive sustainable innovation across the product life cycle by making product sustainability a requirement right from the initial design engineering stage. Although designing around an entirely new set of requirements can be daunting, engineering teams can view it as an opportunity to realize significant cost and CO2 savings, while at the same time creating more sustainable products that are ultimately better for the environment.

The scope to differentiate products and services is shifting toward more sustainable mindsets. Manufacturers that position themselves at the forefront of this trend will only improve their standing in competitive deals.

Final thoughts

The starting place for making strides in sustainability will be unique to your organization. Many are building out from complying with current and looming regulations, while others are beginning to revitalize operations with improved efficiencies and innovating their products and services to be more sustainable.